U.S. Market Profile

full report (PDF)

(Date of Publication: October 11, 2024)

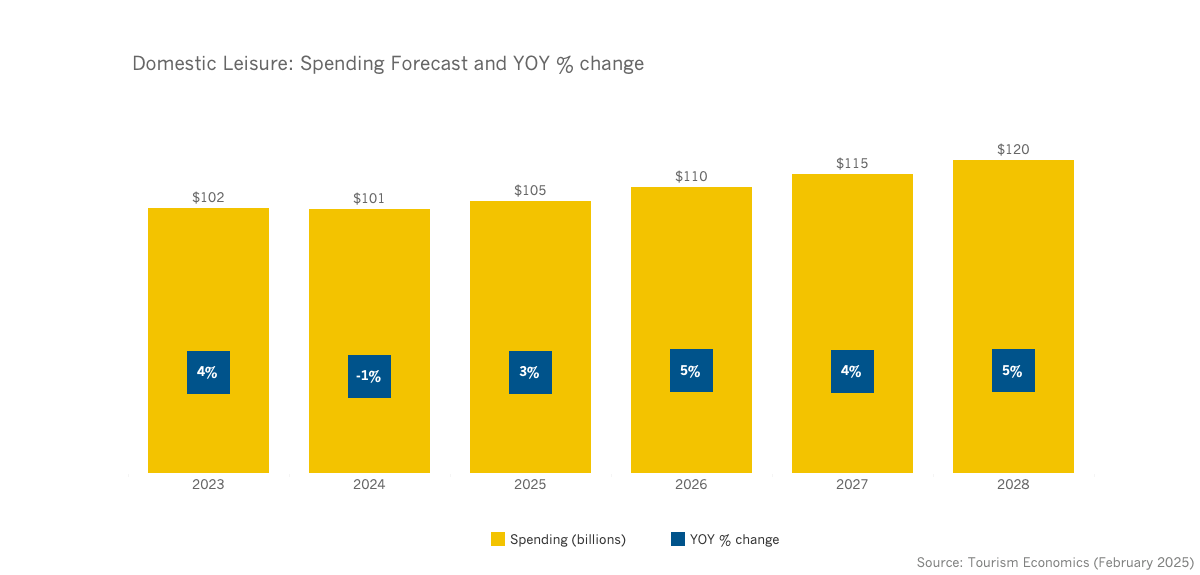

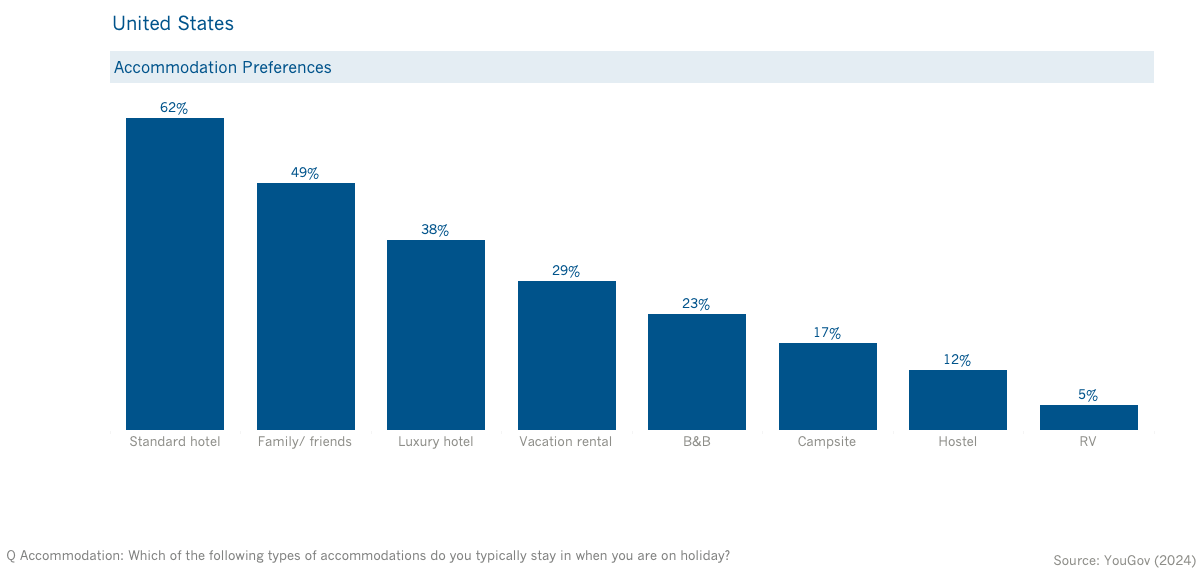

This Global Market Profile report contains two sections. The Market Landscape section offers a look at spending forecasts for California. The Audience Insights section includes data on travel behaviors and accommodation and booking preferences.

MARKET LANDSCAPE

AUDIENCE INSIGHTS

;

;